Popular Now

The Evolution of Afterpay

Afterpay has quickly become a household name in the BNPL industry, but its journey to the top has been marked by innovation and strategic growth.The Founding of Afterpay

Afterpay was founded in 2014 in Australia by Nick Molnar and Anthony Eisen. The idea behind Afterpay was simple: to create a payment solution that would allow consumers to purchase items immediately and pay for them over time without the burden of interest or hidden fees. The founders recognized a gap in the market for a service that combined convenience with financial responsibility, and Afterpay was born.Global Expansion

Since its inception, Afterpay has expanded its operations beyond Australia, entering markets in the United States, Canada, the United Kingdom, and New Zealand. The company's rapid growth has been fueled by partnerships with major retailers and an increasing consumer demand for flexible payment options. Today, Afterpay is used by millions of consumers worldwide, making it one of the leading BNPL services in the market.How Afterpay Works

Understanding how Afterpay functions is key to determining whether it’s the right payment option for you.The Payment Process

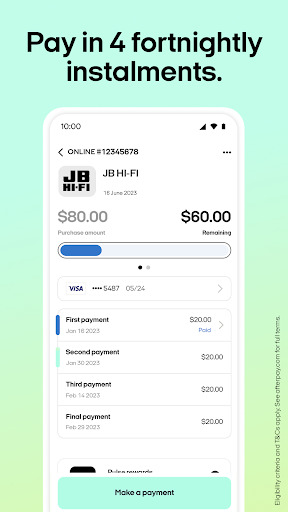

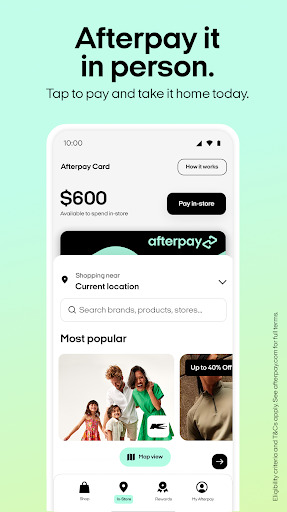

When shopping online or in-store, consumers can select Afterpay as their payment method at checkout. Once selected, the purchase amount is divided into four equal installments, with the first installment due at the time of purchase. The remaining three payments are automatically deducted from the consumer’s linked debit or credit card every two weeks, ensuring a seamless and hassle-free experience.Application and Approval

One of the reasons for Afterpay's popularity is its straightforward application process. Consumers are not subjected to a hard credit check, making it accessible to those with a wide range of credit scores. Approval is usually instantaneous, allowing consumers to complete their purchases without delay. Afterpay does, however, impose spending limits based on the consumer's payment history and the value of the purchase, which helps prevent overspending.Key Features of Afterpay

Several key features set Afterpay apart from other BNPL services, making it a preferred choice for many consumers.Interest-Free Payments

Perhaps the most attractive feature of Afterpay is its interest-free payment structure. Consumers can make purchases and pay for them over time without incurring any interest charges. This feature makes Afterpay an appealing alternative to traditional credit cards, which often come with high-interest rates.Automatic Payments

Afterpay’s automatic payment system ensures that consumers never miss a payment. Payments are deducted automatically from the consumer’s linked card on the due date, reducing the risk of late fees and helping users manage their finances more effectively. This system also means there’s no need to manually track payment dates, making Afterpay a convenient option for busy consumers.Benefits of Using Afterpay

Using Afterpay offers several advantages, particularly for consumers who want to make purchases without immediately depleting their bank accounts.Budgeting and Financial Management

One of the key benefits of Afterpay is its ability to help consumers budget their expenses. By spreading the cost of a purchase over several weeks, consumers can manage their cash flow more effectively. This feature is particularly useful for those who need to make larger purchases but want to avoid the impact on their monthly budget.No Hidden Fees

Afterpay is transparent about its fee structure, with no hidden charges or interest rates. The only fee that consumers may incur is a late fee if a payment is missed. This transparency helps build trust between Afterpay and its users, contributing to the service’s growing popularity.Potential Drawbacks of Afterpay

While Afterpay offers many benefits, it’s important to consider some potential drawbacks before using the service.Late Fees

Although Afterpay is interest-free, consumers who miss a payment may be subject to late fees. These fees can add up quickly if multiple payments are missed, potentially offsetting the benefits of using the service. It’s crucial for consumers to ensure they have sufficient funds in their account on the payment due date to avoid these fees.Impact on Credit Score

While Afterpay does not conduct a hard credit check during the application process, late or missed payments can negatively affect a consumer’s credit score. Afterpay reserves the right to report missed payments to credit bureaus, which can impact the consumer’s ability to obtain credit in the future. This potential drawback highlights the importance of managing payments responsibly.Comparing Afterpay to Other BNPL Services

Afterpay is one of several BNPL services available, and it’s important to compare it to other options to see how it stacks up.Afterpay vs. Affirm

Affirm is another popular BNPL service that offers longer payment terms, typically ranging from three to 36 months. Unlike Afterpay, Affirm charges interest on most of its payment plans, which can be a drawback for consumers looking for interest-free options. However, Affirm offers more flexibility in terms of repayment periods, making it a better choice for larger purchases.Afterpay vs. Klarna

Klarna offers a variety of payment options, including interest-free payments similar to Afterpay. However, Klarna also provides a "Pay Later" option, which allows consumers to make a purchase and pay the full amount within 30 days. While both services offer interest-free payments, Afterpay’s simple four-installment plan is more straightforward, making it easier for consumers to understand and manage.User Experience with Afterpay

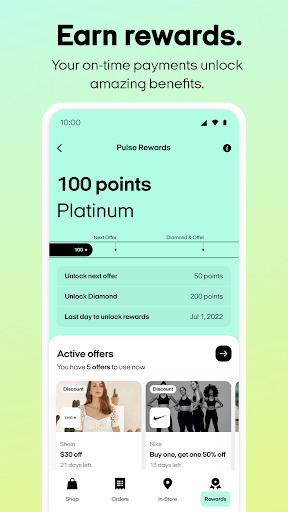

Afterpay’s user experience is a significant factor in its widespread adoption.The Afterpay App

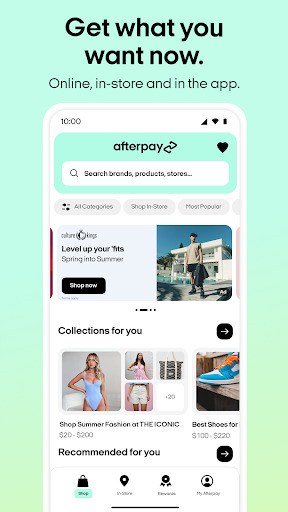

The Afterpay app is user-friendly and allows consumers to manage their payments, view their spending history, and shop at participating retailers all in one place. The app’s intuitive design makes it easy for users to track their purchases and stay on top of their payments, enhancing the overall user experience.Customer Support

Afterpay provides robust customer support through its app and website. Whether consumers need help understanding their payment schedule or managing their account, Afterpay’s customer support team is available to assist. This support, combined with the ease of use of the platform, contributes to a positive overall experience for users.Common Use Cases for Afterpay

Afterpay is versatile and can be used for a wide range of purchases, making it a popular choice among consumers.Fashion and Retail

Fashion and retail are among the most common use cases for Afterpay. Many clothing and accessory retailers partner with Afterpay, allowing consumers to purchase the latest trends and pay for them over time. This flexibility makes it easier for consumers to stay within their budget while still enjoying new fashion items.Travel and Experiences

In addition to retail, Afterpay is increasingly being used for travel and experiences. Many travel companies now offer Afterpay as a payment option, allowing consumers to book vacations, flights, and hotel stays and pay for them in installments. This use case highlights the flexibility of Afterpay in accommodating various consumer needs.Tips for Using Afterpay Responsibly

To get the most out of using Afterpay, consumers should consider a few strategies.Set a Budget

Before using Afterpay, it’s important to set a budget and stick to it. While the service makes it easy to split payments, it’s still important to ensure that the total purchase amount fits within your financial plan. Setting a budget can help prevent overspending and ensure that payments are manageable.Monitor Payment Dates

Since Afterpay automatically deducts payments from your linked account, it’s crucial to monitor your payment dates and ensure that you have sufficient funds available. Keeping track of your payment schedule can help you avoid late fees and maintain a positive payment history.Conclusion

Afterpay has established itself as a leading Buy Now, Pay Later service, offering a convenient and interest-free way for consumers to make purchases. While it’s not without its drawbacks, such as the potential for late fees and the impact on credit scores, the benefits of using Afterpay—including flexible payment options, no hidden fees, and a user-friendly platform—make it an attractive choice for many consumers. Whether you’re looking to finance a fashion purchase or a vacation, Afterpay provides a simple and transparent way to manage your spending.-

Developer

Afterpay

-

Category

Shopping

-

Version

1.83.0

-

Downloads

1M

Pros

👍 1. Flexibility in payment: Afterpay allows users to make purchases upfront and pay off the total amount in four equal installments, spaced out over a six-week period. This can be advantageous for those who want to buy something immediately but may not have the full amount available at the time of purchase.

👍 2. Interest-free: Unlike traditional credit cards, Afterpay does not charge any interest or finance fees. As long as users make their payments on time, they will not incur any additional costs. This can be particularly beneficial for budget-conscious individuals who want to manage their expenses without incurring extra charges.

👍 3. Convenience and simplicity: Afterpay provides a streamlined and straightforward shopping experience. Users can create an account within minutes, and with a few clicks, they can make purchases through partnering retailers. The application also provides a detailed payment schedule and sends reminders when payments are due, making it easy for users to keep track of their spending and payment obligations.

Cons

👎 1. Limited availability: Afterpay is only available in select countries, which limits its accessibility for customers worldwide. This can be a drawback for global businesses or customers who are looking to use the service while traveling.

👎 2. Late fees and interest charges: If customers fail to make their repayments on time, Afterpay charges late fees and interest. Although this is a common practice in buy now, pay later services, it can be a drawback for customers who are not diligent in managing their payments.

👎 3. Potential for overspending: The convenience of Afterpay’s “shop now, pay later” concept can lead to impulse buying and overspending. Customers may be tempted to purchase items they wouldn’t necessarily buy if they had to pay upfront. This can potentially lead to financial strain if not managed responsibly.