Popular Now

What is MySynchrony?

MySynchrony is a financial services company that specializes in providing consumer financing solutions through retail credit cards and promotional financing programs. Partnering with numerous retailers and healthcare providers, MySynchrony aims to offer flexible payment options and financial support tailored to the needs of their clients.Key Features of MySynchrony

- Retail Credit Cards: Offers store-branded credit cards for various retailers, providing special financing options and rewards.

- Promotional Financing: Provides promotional offers such as 0% APR for a set period on qualifying purchases.

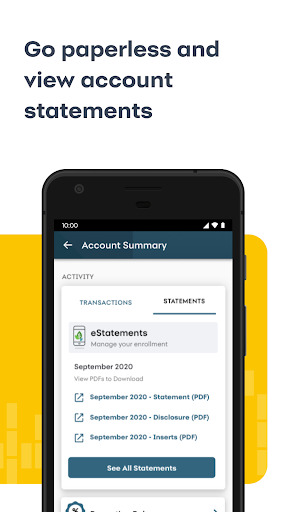

- Online Account Management: Users can manage their accounts, view statements, and make payments through a user-friendly online portal.

How It Works

MySynchrony partners with a variety of retailers and service providers to offer branded credit cards and financing options. Users can apply for credit online or in-store, and upon approval, they receive a credit card or financing plan that can be used at participating locations.Setting Up a MySynchrony Account

Setting up a MySynchrony account involves a straightforward process. This section will guide you through the steps required to get started.Application Process

- Online Application: Visit the MySynchrony website or the website of a participating retailer to apply for a credit card or financing plan.

- Provide Information: Enter personal and financial information, including income, employment status, and social security number.

- Receive Approval: Once your application is processed, you will receive an approval decision, which may include your credit limit and terms.

Account Management

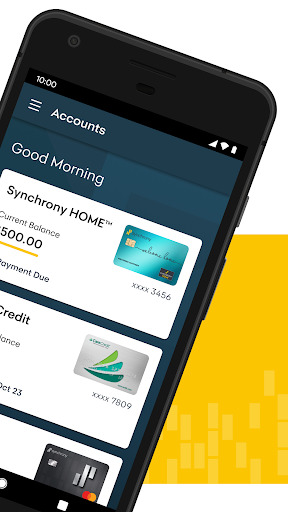

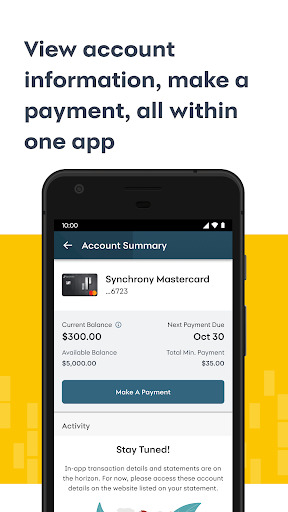

Once your account is set up, you can manage it through the MySynchrony online portal or mobile app. Key functions include:- Viewing Statements: Access your account statements and transaction history.

- Making Payments: Pay your balance or set up automatic payments.

- Managing Personal Information: Update your contact details and account preferences.

MySynchrony User Reviews

Understanding user experiences with MySynchrony provides insight into the practical benefits and potential issues associated with the service. This section reviews feedback from users to offer a balanced perspective.Positive Reviews

Many users appreciate the following aspects of MySynchrony:- Convenience: The ability to manage accounts online and through a mobile app is highly valued, offering easy access to account information and payment options.

- Flexible Financing: Users find the promotional financing offers, such as 0% APR for a set period, to be a significant advantage for managing large purchases.

Negative Reviews

However, some users have reported concerns:- Customer Service Issues: There are complaints about difficulties reaching customer service or receiving inadequate support.

- Fees and Interest Rates: Some users have noted high-interest rates and fees associated with late payments or cash advances.

Comparing MySynchrony with Other Financial Services

To better understand where MySynchrony stands in the market, it’s useful to compare it with other financial services and credit card providers.MySynchrony vs. Capital One

- Capital One: Offers a wide range of credit card options and financial products, including rewards cards and no foreign transaction fees. MySynchrony, in contrast, focuses on retailer-specific credit cards and promotional financing.

- Customer Service: Both companies provide customer support, but Capital One is often noted for its comprehensive customer service and support network.

MySynchrony vs. Synchrony Bank

- Synchrony Bank: The parent company of MySynchrony, offers additional financial products, including savings accounts and CDs. MySynchrony specifically targets consumer financing and retail credit solutions.

- Product Range: Synchrony Bank provides a broader range of financial products beyond the credit and financing options available through MySynchrony.

Recent Updates and New Features

MySynchrony is continuously evolving, with updates and new features being introduced regularly. This section reviews recent changes and what users can expect from future updates.Recent Updates

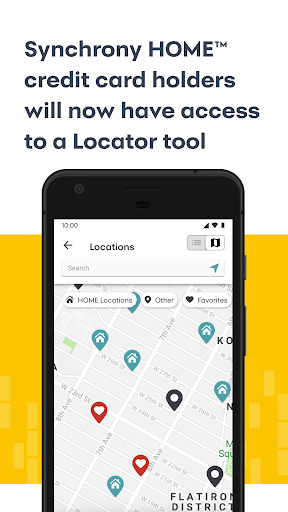

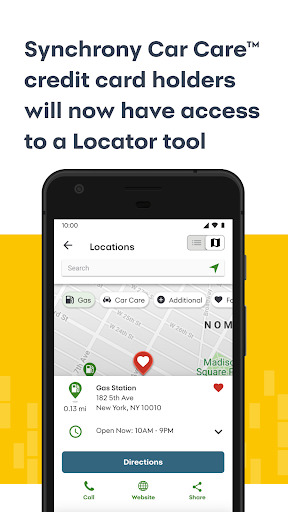

- Enhanced Mobile App: The mobile app has received updates for improved user experience, including faster load times and better navigation.

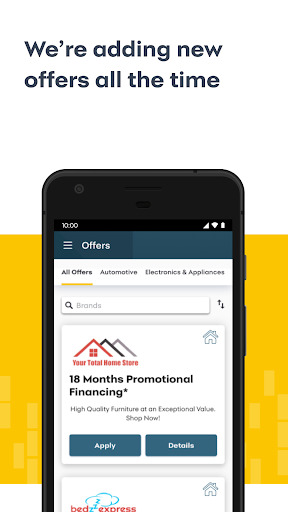

- New Financing Offers: MySynchrony has introduced new promotional financing options, including longer 0% APR periods and additional retailer partnerships.

Upcoming Features

- Integration with Digital Wallets: Future updates may include integration with digital wallet platforms such as Apple Pay and Google Wallet.

- Advanced Account Management Tools: Enhanced tools for tracking spending and managing finances are expected to be introduced.

Customer Support and Service

Effective customer support is crucial for resolving issues and ensuring a positive user experience. This section evaluates the customer support services available with MySynchrony.Support Channels

- Online Help Center: MySynchrony offers an online help center with FAQs and troubleshooting guides.

- Phone Support: Customers can contact MySynchrony’s support team via phone for more personalized assistance.

- Email Support: Email support is available for non-urgent inquiries or detailed assistance.

User Experiences with Support

Customer feedback on support services is mixed. While some users report prompt and helpful responses, others have experienced delays or difficulties resolving issues.Security and Privacy Considerations

With financial services, security and privacy are paramount. MySynchrony employs several measures to protect user data and ensure secure transactions.Data Security Measures

- Encryption: MySynchrony uses encryption to protect sensitive information transmitted between users and the platform.

- Fraud Detection: Advanced fraud detection systems are in place to monitor and prevent unauthorized transactions.

Privacy Policies

MySynchrony’s privacy policies outline how user data is collected, used, and protected. Users should review these policies to understand their rights and the company’s data handling practices.Tips for Maximizing MySynchrony

To fully leverage the benefits of MySynchrony, users can follow these tips and strategies.Optimize Account Use

- Monitor Statements Regularly: Regularly review your account statements to track spending and avoid any potential issues.

- Take Advantage of Promotions: Utilize promotional financing offers to manage large purchases effectively.

Manage Finances Wisely

- Pay on Time: Avoid late fees and interest charges by making payments on time.

- Set Up Alerts: Use account alerts to stay informed about due dates and account activity.

Conclusion

MySynchrony offers a range of financial services designed to provide flexible payment options and convenient account management. While it has received positive reviews for its convenience and financing offers, there are areas where users have reported challenges, particularly with customer service and fees. As MySynchrony continues to evolve and enhance its offerings, it remains a viable option for those seeking tailored financing solutions and easy-to-use account management tools.-

Developer

Synchrony

-

Category

Finance

-

Version

3.0.1

-

Downloads

1M

Pros

👍 1. Easy access to account information: The MySynchrony application allows users to easily access and view their account information from their mobile devices. This includes checking their account balance, viewing transaction history, and making payments.

👍 2. Convenient payment options: With the MySynchrony application, users can conveniently make payments on their accounts. Whether it’s a one-time payment or setting up automatic payments, the app provides various payment options to suit individual preferences. Users can also set up payment reminders to ensure they never miss a payment.

👍 3. Enhanced security features: The MySynchrony application offers enhanced security features to protect users’ account information. This includes features such as biometric authentication (fingerprint or face recognition) and the ability to temporarily lock or unlock the app for added security. Additionally, the app provides real-time transaction alerts, allowing users to monitor their account activity and quickly identify any suspicious or unauthorized transactions.

Cons

👎 1. Limited functionality: One of the shortcomings of the MySynchrony application is its limited functionality compared to other banking applications. While it allows users to view their account balance, transaction history, and make bill payments, it may lack some advanced features such as budgeting tools, expense tracking, or investment options that are available in other financial apps.

👎 2. User interface: Some users have reported that the user interface of the MySynchrony application can be outdated and clunky. The app may not have a modern, intuitive design that makes navigation and finding information easy. This can result in a less user-friendly experience and potentially frustrate users who are accustomed to more visually appealing and intuitive interfaces.

👎 3. Technical issues: Another shortcoming of the MySynchrony application is occasional technical issues or glitches that users may encounter. This can include problems with logging in, delays in updating account balances or transactions, or errors when trying to make payments. While these issues may not be widespread, they can be frustrating for users relying on the app for managing their finances.