Popular Now

1. Getting Started with Venmo

To begin using Venmo, you'll need to download the app and set up an account. Here's a step-by-step guide to help you get started.1.1. Downloading and Installing the Venmo App

The Venmo app is available for both iOS and Android devices. To download, simply go to the Apple App Store or Google Play Store, search for "Venmo," and install the app.1.2. Creating a Venmo Account

Once the app is installed, open it and follow the on-screen instructions to create an account. You'll need to provide your email address or phone number, create a password, and link your bank account or credit card to start sending and receiving money.2. Understanding Venmo's User Interface

The Venmo app is known for its user-friendly interface, which combines payment features with social elements.2.1. Navigating the Home Screen

The home screen is where you'll find your transaction feed, showing payments made by you and your friends. You can like and comment on transactions, adding a social element to your payments.2.2. Accessing the Menu and Settings

The app's menu is located in the top left corner of the screen. Here, you can access your profile, payment methods, settings, and transaction history.3. Sending and Receiving Money

Venmo's primary function is to allow users to send and receive money quickly and easily.3.1. How to Send Money

To send money, tap the "Pay or Request" button, enter the recipient's username or phone number, specify the amount, and add a note if desired. Confirm the payment, and the money will be sent instantly.3.2. How to Receive Money

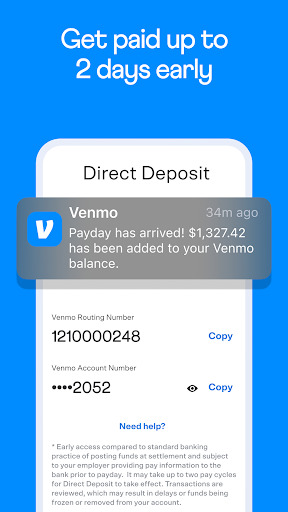

When someone sends you money, you'll receive a notification. The funds will appear in your Venmo balance, which you can either keep in the app for future payments or transfer to your bank account.4. Splitting Bills with Venmo

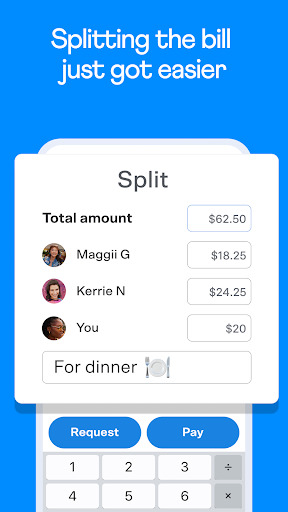

One of Venmo's most popular features is its ability to split bills among friends.4.1. Splitting Payments

Whether you're splitting a restaurant bill, rent, or a group gift, Venmo makes it easy. Simply enter the total amount, select the friends you want to split with, and Venmo will automatically divide the cost.4.2. Requesting Money

You can also request money from friends by entering the amount they owe and sending a payment request. Venmo will notify them, and they can pay you with just a few taps.5. Venmo's Social Features

Venmo sets itself apart from other payment apps with its social feed, where users can see and interact with each other's transactions.5.1. The Transaction Feed

The transaction feed displays payments made by your friends, along with the notes they included. You can like and comment on these transactions, creating a social experience around money transfers.5.2. Privacy Settings

While the social feed is a fun feature, it's essential to understand Venmo's privacy settings. You can choose to make transactions public, visible only to friends, or entirely private.6. Linking Payment Methods

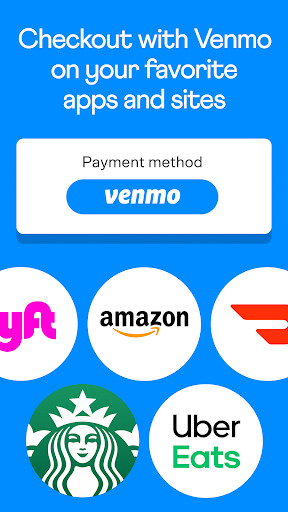

Venmo allows you to link multiple payment methods, giving you flexibility in how you fund your transactions.6.1. Adding a Bank Account

To add a bank account, go to the "Payment Methods" section in the settings menu, select "Add Bank Account," and follow the prompts to link your account.6.2. Adding a Credit or Debit Card

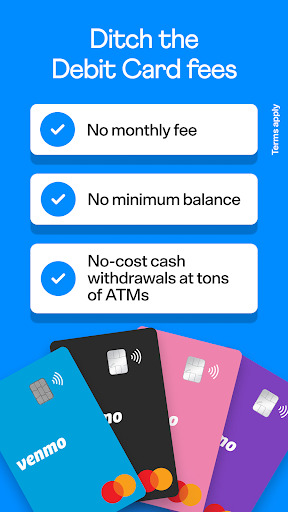

You can also add credit or debit cards as payment methods. Simply enter your card details in the app, and Venmo will store them for future use.7. Security Features of Venmo

Security is a top concern for any payment app, and Venmo offers several features to protect your account.7.1. Two-Factor Authentication

Venmo allows you to enable two-factor authentication (2FA) for added security. With 2FA, you'll need to enter a verification code sent to your phone each time you log in.7.2. PIN Code and Touch ID

You can set up a PIN code or use your phone's Touch ID to secure the app. This ensures that even if someone gains access to your phone, they won't be able to use your Venmo account.8. Venmo for Business

Venmo isn't just for personal payments; businesses can also use the app to accept payments from customers.8.1. Setting Up a Business Profile

Businesses can create a Venmo profile to accept payments. Customers can pay businesses just like they would pay a friend, making transactions quick and easy.8.2. Transaction Fees for Businesses

While personal payments are free, Venmo charges a small fee for business transactions. It's important to be aware of these fees when using Venmo for commercial purposes.9. Troubleshooting Common Issues

Like any app, Venmo users may encounter issues from time to time. Here's how to resolve some common problems.9.1. Failed Transactions

If a transaction fails, check your internet connection, ensure your payment method is valid, and try again. If the problem persists, contact Venmo support.9.2. Account Verification Issues

If you're having trouble verifying your account, make sure you've entered all information correctly. Venmo may also require additional documentation for verification.10. Tips for Maximizing Your Venmo Experience

To get the most out of Venmo, consider these tips and tricks.10.1. Utilize Venmo Offers

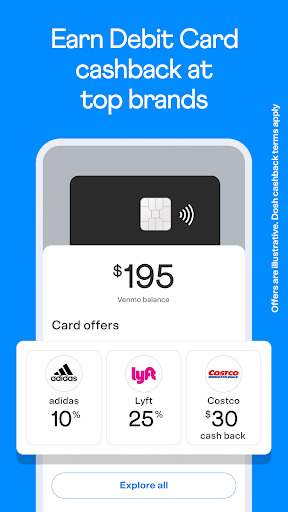

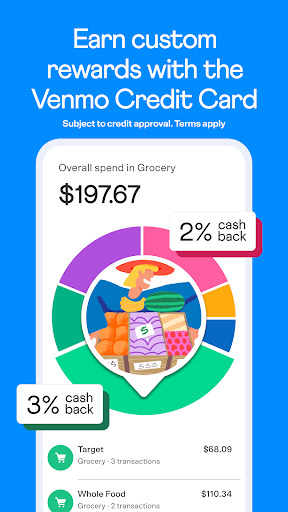

Venmo occasionally offers discounts and cashback deals when you use the app to make purchases at specific retailers. Keep an eye out for these promotions to save money.10.2. Managing Your Venmo Balance

Regularly transfer your Venmo balance to your bank account to ensure your funds are secure. You can also use your Venmo balance to make payments directly within the app.Conclusion

The Venmo app has become an essential tool for millions of people, offering a convenient way to send and receive money, split bills, and even pay businesses. With its user-friendly interface, social features, and robust security, Venmo stands out as one of the best mobile payment apps on the market. Whether you're using it for everyday transactions or managing a small business, Venmo has the tools and features to make your financial life easier.-

Developer

PayPal, Inc.

-

Category

Finance

-

Version

10.24.0

-

Downloads

50M

Pros

Pro

👍 1. Convenience: Venmo allows users to easily send money to friends, family, or even businesses with just a few taps on their smartphones. It eliminates the need for physical cash or checks, making it a convenient option for splitting bills, paying back debts, or making small purchases.

👍 2. Speed: Venmo transfers money instantly, allowing users to quickly send and receive funds. This eliminates the need for waiting for checks to clear or for bank transfers to process, making it particularly useful for time-sensitive payments.

👍 3. Social features: Venmo has social features that allow users to add comments or emojis to their transactions, making it a fun and interactive way to send and receive money. Users can also view and like their friends’ transactions, creating a social network within the app. This makes it more engaging and entertaining than traditional payment methods.

Cons

Con

👎 1. Limited availability: One major shortcoming of Venmo is its limited availability outside of the United States. While it is widely used and accepted within the country, users outside of the U.S. may find it challenging to use Venmo to send and receive money.

👎 2. Privacy concerns: Venmo has faced criticism for its privacy practices. By default, transactions made on Venmo are visible to the public unless users manually adjust their privacy settings. This lack of default privacy can potentially expose users’ financial transactions to the public, raising concerns about privacy and security.

👎 3. Customer support: Many users have reported difficulties in reaching Venmo’s customer support and receiving timely and satisfactory assistance. The lack of responsive customer support can be frustrating when users encounter issues with transactions, account access, or security concerns