Popular Now

What is NetSpend?

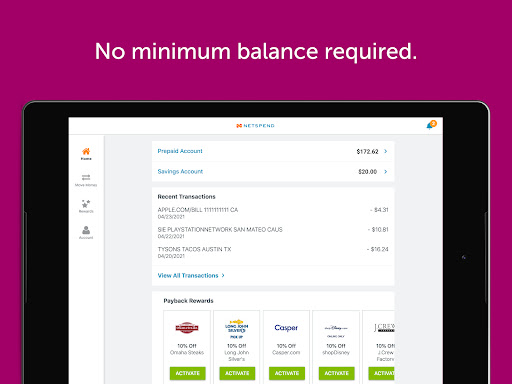

NetSpend, a subsidiary of Global Payments Inc., provides prepaid debit cards that function similarly to traditional bank accounts but without the need for a conventional bank. These cards are designed for users who may not have access to traditional banking services or prefer the flexibility of a prepaid card.Key Features of NetSpend Cards

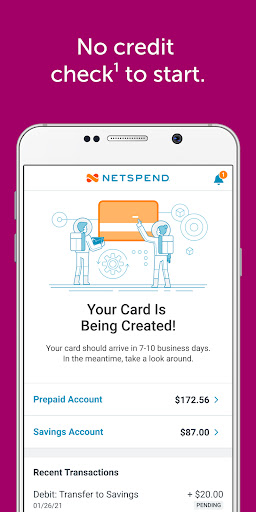

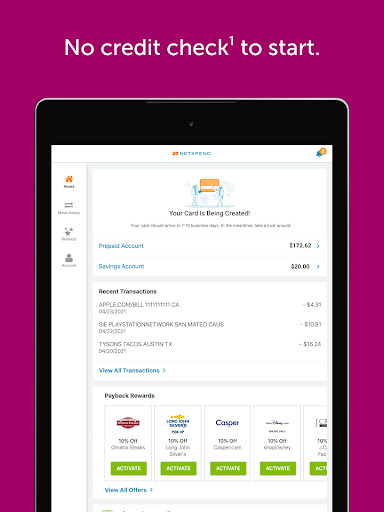

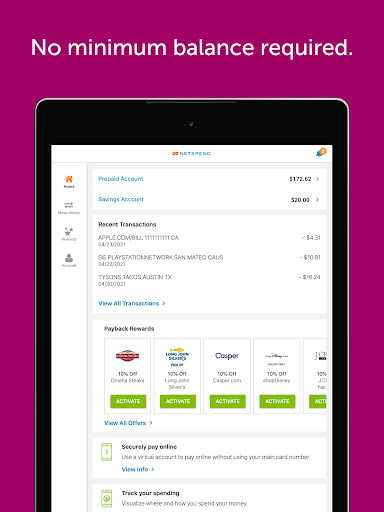

- No Credit Check Required: NetSpend cards do not require a credit check for approval, making them accessible to individuals with varying credit histories.

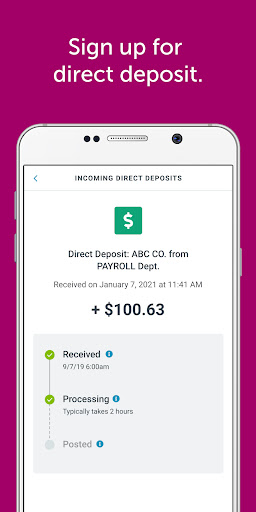

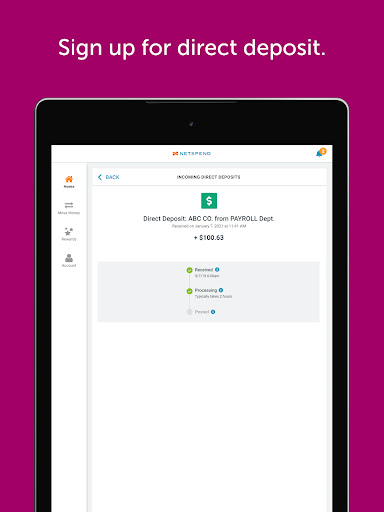

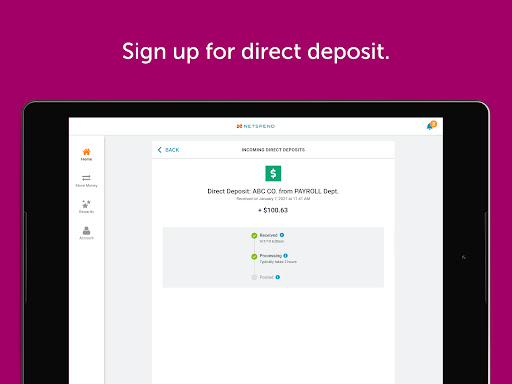

- Direct Deposit: Users can have their paychecks or government benefits deposited directly onto their NetSpend card, streamlining access to funds.

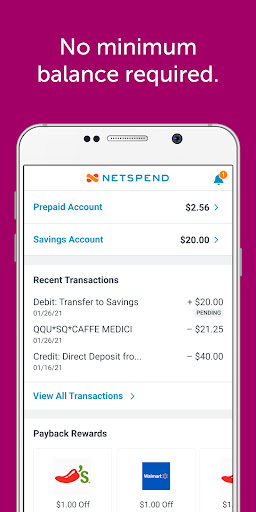

- Online and Mobile Banking: NetSpend offers online and mobile banking options, allowing users to manage their accounts, track spending, and perform transactions conveniently.

Types of NetSpend Cards

- NetSpend Prepaid Mastercard®: This card offers the convenience of a Mastercard with widespread acceptance.

- NetSpend Visa® Prepaid Card: Similar to the Mastercard version, this card provides the benefits of Visa’s extensive network.

Setting Up Your NetSpend Card

Setting up a NetSpend card is designed to be straightforward. Here’s a step-by-step guide to get you started:Activating Your Card

- Receive Your Card: Once you receive your NetSpend card, it will come with an activation code and instructions.

- Online Activation: Visit the NetSpend website or use the NetSpend mobile app to activate your card. Enter the activation code and follow the prompts to complete the process.

- Load Funds: You can add funds to your card through direct deposit, bank transfers, or cash reload options available at participating locations.

Setting Up Direct Deposit

- Obtain Direct Deposit Form: Download the direct deposit form from the NetSpend website or request one through customer service.

- Provide Banking Information: Fill out the form with your NetSpend card details and provide it to your employer or the relevant institution handling your benefits.

- Confirmation: Once your direct deposit is set up, you’ll receive notifications when funds are deposited onto your card.

NetSpend User Reviews

User reviews provide valuable insights into the performance and user experience of NetSpend cards. This section summarizes common feedback from users.Positive Reviews

Many users highlight the following benefits of NetSpend:- Convenience: NetSpend cards offer easy access to funds and the ability to manage finances without a traditional bank account. The direct deposit feature is particularly appreciated for its efficiency.

- Accessibility: Users value the lack of credit checks and the ability to obtain a card regardless of credit history.

Negative Reviews

Some users have expressed concerns about:- Fees: NetSpend cards come with various fees, including monthly maintenance fees, ATM withdrawal fees, and reload fees. These can add up and affect the overall value.

- Customer Service: There have been reports of challenges with customer service, including long wait times and difficulties resolving issues.

Comparing NetSpend with Other Prepaid Cards

To understand NetSpend’s position in the prepaid card market, it’s helpful to compare its offerings with those of other providers.NetSpend vs. Green Dot

- Green Dot: Green Dot is another popular prepaid card provider known for its straightforward fee structure and wide availability. Green Dot cards also offer direct deposit and online banking features.

- Cost Comparison: Green Dot generally has a simpler fee structure compared to NetSpend, which may appeal to users looking for cost-effective options.

NetSpend vs. Bluebird by American Express

- Bluebird: Bluebird is a prepaid card offered by American Express with no monthly fees and a range of features, including bill pay and money transfer options.

- Features and Fees: Bluebird often has fewer fees compared to NetSpend and offers additional features like family accounts and financial tools.

Recent Updates and New Features

NetSpend continually updates its offerings to enhance user experience and meet evolving needs. This section reviews recent updates and new features.Recent Updates

- Enhanced Mobile App: The NetSpend mobile app has been updated to include more features, such as real-time transaction alerts and improved account management tools.

- Fee Reductions: NetSpend has made adjustments to its fee structure in response to user feedback, including reductions in certain transaction fees.

Upcoming Features

- Financial Planning Tools: Future updates may include enhanced financial planning tools, allowing users to better manage their budgets and savings.

- Increased Integration: NetSpend is expected to increase its integration with other financial services and digital wallets for more seamless transactions.

Customer Support and Service

Effective customer support is crucial for resolving issues and ensuring a positive user experience. This section evaluates the customer support services provided by NetSpend.Support Channels

- Online Help Center: NetSpend offers an extensive online help center with articles, FAQs, and troubleshooting guides to assist users with common issues.

- Phone Support: Users can contact NetSpend’s customer service team via phone for personalized assistance and issue resolution.

- Social Media and Email: NetSpend also provides support through social media channels and email for additional communication options.

User Experiences with Support

Overall, user experiences with NetSpend’s customer support are mixed. While some users appreciate the availability of multiple support channels, others have reported difficulties with getting timely and effective assistance.Security and Privacy Considerations

Security and privacy are critical aspects of financial services. NetSpend takes various measures to protect user data and ensure secure transactions.Security Measures

- Fraud Protection: NetSpend provides fraud protection features, including alerts for suspicious transactions and the ability to report lost or stolen cards quickly.

- Encryption: Data transmitted through NetSpend’s online and mobile platforms is encrypted to protect it from unauthorized access.

Privacy Policies

NetSpend’s privacy policies outline how user data is collected, used, and protected. It is important for users to review these policies to understand how their information is managed and their rights regarding data privacy.Tips for Maximizing Your NetSpend Card

To make the most of your NetSpend card, consider the following tips:Managing Fees

- Understand Fee Structure: Familiarize yourself with the fee structure associated with your NetSpend card to avoid unexpected charges. Look for ways to minimize fees, such as using direct deposit or avoiding ATM withdrawals.

- Choose the Right Plan: NetSpend offers different plans with varying fee structures. Select a plan that best suits your usage patterns and financial needs.

Regular Monitoring

- Track Transactions: Use the NetSpend mobile app or online account to monitor transactions regularly. This helps you stay informed about your spending and detect any unauthorized activity.

- Set Budgeting Goals: Take advantage of any budgeting tools provided by NetSpend to manage your finances effectively and achieve your financial goals.

Conclusion

NetSpend offers a range of prepaid card solutions designed to provide financial flexibility and accessibility. While its cards are praised for convenience and ease of use, some users have raised concerns about fees and customer service. Overall, NetSpend remains a popular choice for individuals seeking an alternative to traditional banking. As the company continues to evolve and enhance its offerings, it is likely to maintain its position as a leading provider in the prepaid card market.-

Developer

NetSpend

-

Category

Finance

-

Version

6.5.2

-

Downloads

5M

Pros

👍 1. Convenient and easy access to managing your money: The Netspend Manage Money Online application provides a user-friendly interface that allows you to manage your finances anytime, anywhere. You can easily track your transactions, view your balance, and set up alerts to stay updated on your account activity.

👍 2. Enhanced budgeting and spending control: With Netspend, you can create budgets and set spending limits to help you stay on track with your financial goals. The application offers tools and features such as spending analytics and transaction categorization, which provide valuable insights into your spending habits and enable you to make informed decisions about your money.

👍 3. Safe and secure transactions: Netspend prioritizes the security and privacy of its users. The Manage Money Online application uses advanced encryption technology to protect your personal and financial information. Additionally, Netspend offers features like card activation and deactivation, as well as transaction alerts, to help you quickly identify and report any unauthorized activity on your account.

Cons

👎 1. Limited features: The Netspend: Manage Money Online application has a relatively limited range of features. Users may find that certain functionalities they are accustomed to with other banking apps, such as bill pay or mobile check deposit, are not available on the Netspend app.

👎 2. User interface and design: Some users may find the user interface and design of the Netspend app to be outdated or not as intuitive as other banking apps. The navigation and organization of features could be improved to enhance the user experience.

👎 3. Customer support: While Netspend offers customer support services, some users have experienced difficulties in reaching a live representative or receiving timely responses to inquiries. Improvements in customer support could enhance the overall user experience for Netspend app users.