Popular Now

The Rise of Buy Now, Pay Later Services

The concept of Buy Now, Pay Later has been around for decades, but its digital transformation has brought it into the mainstream.The Early Days of Installment Payments

Installment payments have long been a part of consumer finance, allowing people to purchase big-ticket items without paying the full price upfront. Traditional layaway programs were among the first to offer this option, where consumers made payments over time but only received the product after completing the payment plan. Affirm and other BNPL services have revolutionized this concept by allowing consumers to receive their products immediately and pay for them in installments.The Digital Revolution

The digital age has brought significant changes to the way installment payments work. With the rise of e-commerce, BNPL services like Affirm have gained popularity, offering a seamless and convenient way to finance purchases. Unlike traditional credit cards, these services are often easier to qualify for, making them accessible to a broader audience.What is Affirm?

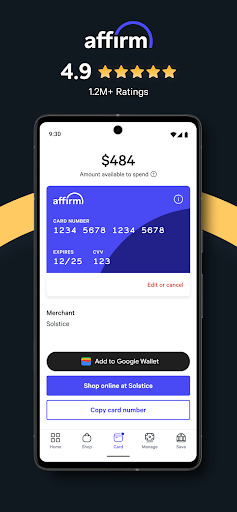

Affirm is a financial technology company that provides consumers with the option to pay for their purchases over time. Unlike traditional credit cards, Affirm offers transparent terms with no hidden fees, making it an attractive option for consumers who want more control over their spending.How Affirm Works

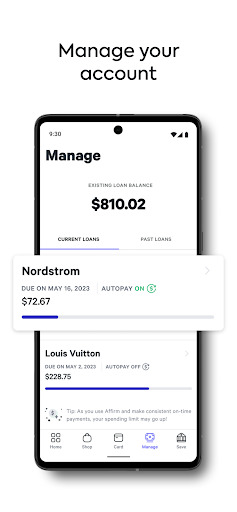

When shopping online, consumers can select Affirm at checkout as a payment method. Once selected, they are presented with various payment options, which typically range from three to 36 months. The terms, including the interest rate and monthly payment, are clearly displayed, allowing consumers to choose the plan that best fits their budget.The Application Process

The application process for Affirm is straightforward. Consumers provide basic information, and Affirm conducts a soft credit check, which does not affect their credit score. If approved, the consumer can complete their purchase and begin making payments according to the chosen plan. The simplicity and transparency of Affirm’s application process are key factors in its popularity.Key Features of Affirm

Affirm stands out in the BNPL market due to several key features that make it a preferred choice for many consumers.Transparent Terms and Conditions

One of the most significant advantages of using Affirm is its commitment to transparency. Unlike traditional credit cards, which often come with hidden fees and confusing terms, Affirm clearly outlines the terms of each loan. Consumers know exactly what they’ll pay, including the interest rate and total cost, before they commit to a purchase.No Hidden Fees

Affirm prides itself on having no hidden fees. There are no late fees, service fees, or prepayment penalties, making it a straightforward and consumer-friendly option. This transparency helps build trust between Affirm and its users, contributing to its growing popularity.Benefits of Using Affirm

Using Affirm offers several benefits, particularly for consumers who want to manage their finances more effectively.Flexible Payment Options

Affirm’s flexible payment options allow consumers to choose a payment plan that fits their budget. Whether it’s a short-term plan with higher monthly payments or a longer-term plan with lower payments, Affirm provides flexibility that traditional credit cards often lack.Building Credit Responsibly

For consumers looking to build or improve their credit, using Affirm can be a smart choice. Affirm reports payment history to credit bureaus, so consistent, on-time payments can help improve a consumer’s credit score. This feature makes Affirm not only a convenient financing option but also a tool for building credit responsibly.Potential Drawbacks of Affirm

While Affirm offers many benefits, it’s important to consider some potential drawbacks before using the service.Interest Rates Can Vary

One of the main criticisms of Affirm is that its interest rates can vary widely. Depending on the consumer’s creditworthiness, interest rates can range from 0% to as high as 30%. While some consumers may qualify for 0% financing, others may end up paying significantly more in interest than they would with other financing options.Limited Availability with Certain Merchants

Another potential drawback is that Affirm is not accepted by all merchants. While it is available at many major retailers, there are still some places where consumers cannot use Affirm as a payment option. This limitation can be frustrating for consumers who prefer to use Affirm for all their purchases.How Affirm Compares to Other BNPL Services

Affirm is one of several BNPL services available, and it’s important to compare it to other options to see how it stacks up.Affirm vs. Afterpay

Afterpay is another popular BNPL service that offers a slightly different approach. While Affirm allows for longer payment terms and charges interest on some plans, Afterpay typically offers interest-free financing for four equal installments. For consumers who prefer short-term, interest-free payments, Afterpay may be a better option, but those who need more time to pay may prefer Affirm’s flexible terms.Affirm vs. Klarna

Klarna is another competitor in the BNPL space, offering a mix of short-term, interest-free payments and longer-term financing options. Klarna also provides additional features like shopping rewards and a mobile app with personalized shopping experiences. However, Affirm’s commitment to transparency and its straightforward terms make it a strong contender, especially for consumers who prioritize clear, upfront information.User Experience with Affirm

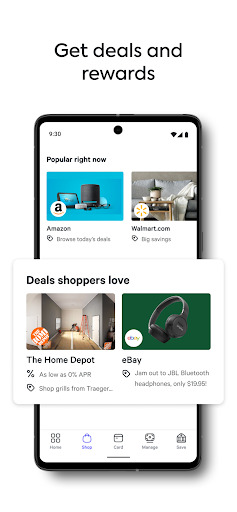

Affirm is known for its user-friendly platform, which contributes to its popularity among consumers.The Affirm App

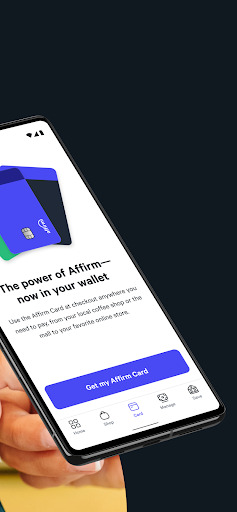

The Affirm app allows users to manage their loans, make payments, and browse participating merchants all in one place. The app’s intuitive design makes it easy for users to stay on top of their payments and view their spending history.Customer Support

Affirm also offers excellent customer support, with resources available through its app and website. Whether consumers need help understanding their loan terms or managing their account, Affirm’s customer support team is available to assist, providing a positive overall experience.Common Use Cases for Affirm

Affirm is used for a variety of purchases, making it a versatile financing option for many consumers.Financing Large Purchases

One of the most common uses of Affirm is for financing large purchases, such as furniture, electronics, and appliances. Affirm allows consumers to spread the cost of these big-ticket items over several months or years, making them more affordable.Travel and Leisure

Affirm is also popular for financing travel and leisure expenses. Many travel companies and airlines partner with Affirm, allowing consumers to pay for vacations, flights, and hotel stays over time. This flexibility makes it easier for consumers to plan and enjoy their trips without the stress of upfront payments.How to Maximize the Benefits of Affirm

To get the most out of using Affirm, consumers should consider a few strategies.Pay Attention to Interest Rates

While Affirm offers transparent terms, it’s important to carefully consider the interest rate before committing to a payment plan. If the rate is high, it may be worth exploring other financing options or paying in full if possible.Use Affirm for Budgeting

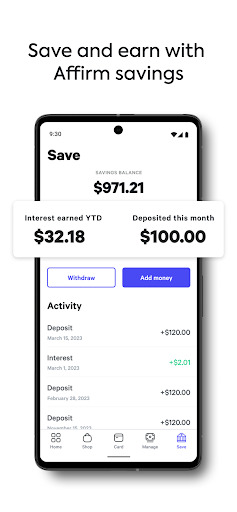

Affirm can also be a useful tool for budgeting. By spreading payments over time, consumers can manage their cash flow more effectively and avoid the pitfalls of high-interest credit card debt. Using Affirm for budgeting can help consumers stay on track with their financial goals while still enjoying the flexibility of BNPL services.Conclusion

Affirm has emerged as a leading player in the Buy Now, Pay Later space, offering a transparent, flexible, and user-friendly alternative to traditional credit cards. While it’s not without its drawbacks, such as varying interest rates and limited merchant availability, the benefits of using Affirm make it a compelling option for many consumers. Whether you’re looking to finance a large purchase or simply want more control over your spending, Affirm provides a convenient and responsible way to manage your finances.-

Developer

Affirm, Inc

-

Category

Shopping

-

Version

3.188.4

-

Downloads

5M

Pros

👍 1. Increased purchasing power: One of the main advantages of using Affirm is that it allows users to make purchases they may not have been able to afford in one lump sum. By splitting payments over time, Affirm provides individuals with increased purchasing power, making it easier to afford larger or more expensive items.

👍 2. Transparent and easy to use: Affirm offers a user-friendly application that simplifies the buying process. Users can easily see the monthly installment terms and interest rates, providing full transparency regarding the cost of their purchase. The application process is quick and straightforward, requiring only basic personal information and returning an instant decision, often avoiding the need for a credit check.

👍 3. Flexible repayment options: Affirm offers flexibility in repayment terms. Users can choose the repayment option that best suits their needs, with terms ranging from 3 to 36 months. This flexibility allows individuals to manage their payments based on their financial situation and preferences. Additionally, Affirm offers scheduled automatic payments, ensuring that payments are made on time and avoiding late fees.

Cons

👎 1. Limited merchant acceptance: One major shortcoming of Affirm is that it is not accepted by all merchants. While Affirm has a growing list of partner merchants, there are still many popular brands and retailers that do not offer Affirm as a payment option. This limits the potential for users to use Affirm on a wide range of products they may be interested in purchasing.

👎 2. Interest rates: Although Affirm advertises itself as a more transparent and affordable alternative to traditional credit cards, it is important to note that Affirm charges interest rates on their loans. While these rates can vary depending on factors like creditworthiness and loan terms, they can still be relatively high compared to other financing options. This can result in users paying more for their purchases in the long run.

👎 3. Creditworthiness requirements: Affirm conducts a credit check before approving a user for a loan, which means that not everyone may be eligible for financing through the platform. This can be a disadvantage for individuals with poor credit scores or limited credit history, as it may prevent them from being able to use Affirm to make purchases. This lack of accessibility can be a drawback for potential users who are seeking flexible payment options.